Buying a property is one of the most significant financial decisions you’ll ever make. Whether it’s a flat, open plot, villa, or commercial space, thorough verification before closing the deal can protect you from legal complications, financial loss, and future stress.

Below are the essential checks you should always complete before buying property in India.

1. Verify Property Ownership

Ensure that the seller is the lawful owner of the property and has the legal right to sell it. Carefully examine the title deed to confirm that ownership is clear, valid, and transferable. Properties with disputed or multiple ownership should be approached with caution.

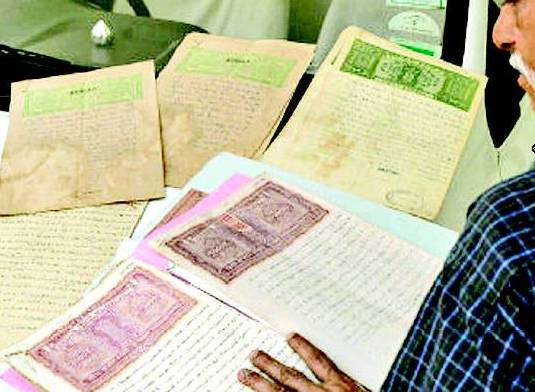

2. Check All Property Documents

Make sure all required documents are available, accurate, and up to date, including:

-

Sale Deed

-

Mother Deed

-

Encumbrance Certificate (EC)

-

Approved Layout Plan

-

Building Approval (if applicable)

Incomplete or incorrect documentation can result in serious legal problems later.

3. Confirm Government Approvals

For flats and plots, verify approvals from the appropriate authorities such as HMDA, DTCP, RERA, or the local municipal body. Approved properties are safer investments and easier to resell or finance.

4. Look for Encumbrances & Legal Issues

Ensure the property is free from loans, disputes, or ongoing legal cases. An Encumbrance Certificate helps confirm that there are no outstanding financial or legal liabilities attached to the property.

5. Evaluate Location & Connectivity

A good location adds long-term value. Check for:

-

Road access and connectivity

-

Availability of public transport

-

Distance from schools, hospitals, offices, and markets

The right location enhances both lifestyle and future appreciation.

6. Review Infrastructure & Amenities

For apartments and gated communities, assess the availability and quality of amenities such as water supply, electricity, drainage, parking, security, and maintenance systems.

7. Research Builder or Seller Reputation

If buying from a builder or developer, review their past projects, delivery timelines, and customer feedback. A reliable developer minimizes the risk of delays, quality issues, and unmet promises.

8. Check Price & Market Value

Compare the property price with similar options in the surrounding area to ensure it aligns with the current market rate. Prices that seem unusually low may indicate hidden risks.

9. Understand Agreement & Payment Terms

Read the sale agreement carefully before signing. Pay close attention to payment schedules, possession dates, penalties, and refund clauses to avoid misunderstandings later.

10. Complete Registration & Stamp Duty

Ensure the property is properly registered in your name and that stamp duty is paid as per state regulations. This step legally establishes your ownership.

Final Thoughts

Taking the time to verify these critical aspects before purchasing a property can safeguard your investment and provide long-term peace of mind. A well-researched property is more than just a purchase—it’s a secure future.

At FlatsPlots, we strive to make your property search simple, transparent, and trustworthy. Explore verified flats, plots, and properties across India with complete confidence.

.png)